*/

Matthew Amey looks at the removal of recoverability of success fees and ATE insurance premiums, and the impact this will have on commercial litigation counsel

Matthew Amey looks at the removal of recoverability of success fees and ATE insurance premiums, and the impact this will have on commercial litigation counsel

Losing recoverability means losing control. Over the past decade, not all barristers have embraced the idea of sharing risk with their clients through conditional fee arrangements (‘CFAs’). Indeed, some felt that it adversely affected their independence when providing advice to the client, particularly with regard to settlement offers.

Nonetheless, recoverability of CFA success fees has meant that the CFA retainer, as a funding option, has allowed counsel greater control over who can access their expertise. Recoverability of CFA success fees has meant that, where counsel is willing to share risk with an impecunious client, and provided the success fee can be justified, there is a workable mechanism to do so without diluting the client’s damages award.

The same has been true of after the event (‘ATE’) insurance with recoverable premiums. Outside of personal injury, most ATE policies will, in the absence of a CFA, cover barristers’ fees as standard. ATE insurers used to be less willing to offer such cover but over the years, they have become more sanguine about this as it has become increasingly apparent that getting a barrister to agree to act under a CFA does not automatically mean there is a good case. Recoverable ATE premiums have allowed greater access to good quality counsel whose chambers are not willing for whatever reason to share risk via CFAs with their clients. Clients are far more willing to fund counsel’s fees as the case progresses if they know this outlay is covered by insurance in the event the case is lost.

All this however would be dismantled by the Legal Aid, Sentencing and Punishment of Offenders Bill which is implementing Sir Rupert Jackson’s recommendation to abolish recoverability of success fees and ATE premiums. Clause 41 requires that CFAs must provide that the success fee is subject to a maximum limit, the percentage not exceeding the percentage specified by an order made by the Lord Chancellor, and expressed as a percentage of the descriptions of damages awarded in the proceedings.

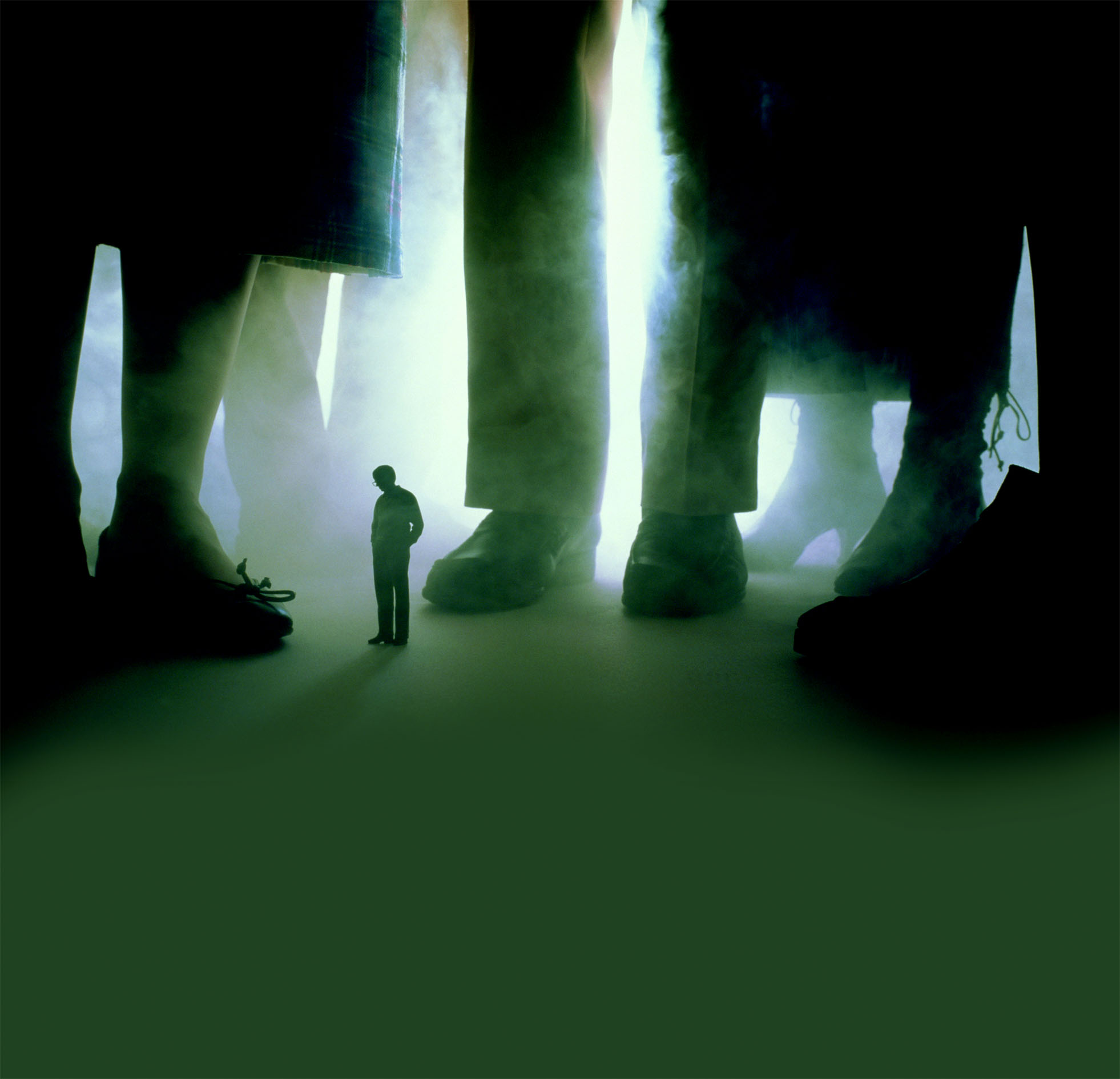

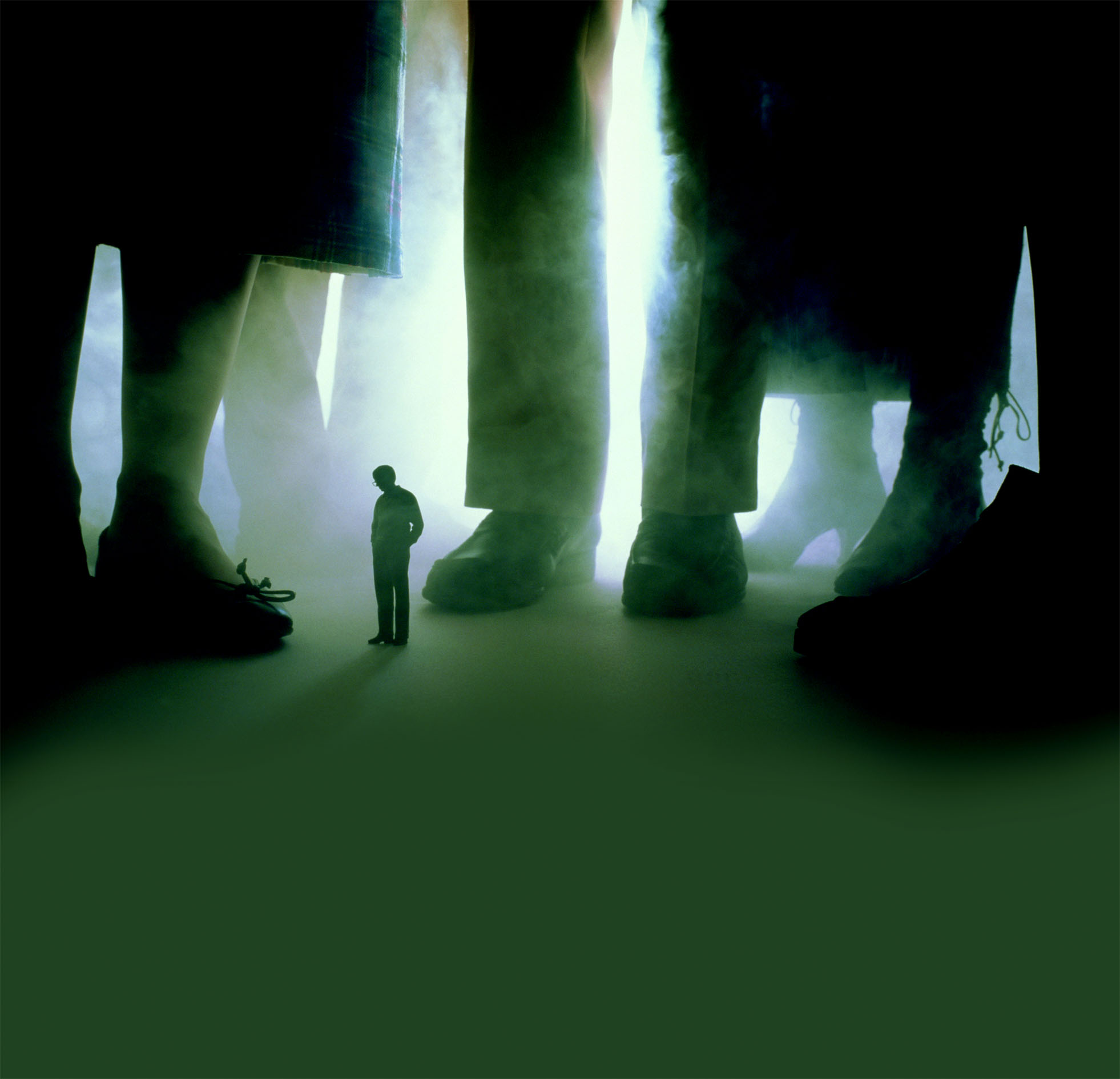

The real losers will be those clients who have less resource to bring their claims. Arguably, society at large also loses out as access to justice diminishes for individuals and small and medium sized enterprises (SMEs). A barrister’s ability to share risk and reap the reward for doing so will now be restricted to only high value litigation. Counsel will no longer be able to share risk in low value cases, no matter how meritorious or important it is, unless they are willing to do so in return for a disproportionately small reward. It seems improbable that this will happen too often. As a result, fewer litigants with lower value cases will be able to fund the fees of a good quality barrister, and the playing field will be tipped in favour of the party with the better resources.

The introduction of Damages Based Agreements (‘DBAs’) does nothing to help the lower value cases but it could be good news for counsel engaged on very high value disputes. A DBA can provide a far greater return for sharing risk than a CFA uplift which is capped at 100% of fees. For the most highly regarded barristers, DBAs represent a chance to make a great deal of money on “big ticket” commercial litigation, provided they can pick the winners. However, it is probably a mirage for counsel occupying the tiers below the top. With the removal of recoverability also comes the introduction of real price competition within the profession in relation to the “reward” element of a CFA or DBA. Many solicitors and counsel will find themselves having to reduce their success fee element in order to secure instructions. Indeed, some solicitors in personal injury claims are predicting a world of CFAs without any success fees.

The silver lining attached to the Government’s proposals for counsel is that the reforms will bolster the nascent litigation funding market. Whilst DBAs represent competition for Third Party Funders, barristers will be more interested in the ability of the client to secure external litigation financing in order to pay their hourly rates as the case progresses.

Third Party Funding has had a limited impact on the profession to date as a result of the small number of companies in the market offering funding and because the fees charged have been expensive (typically expressed as a percentage of the damages or a multiple of the amount of funding committed). It is not uncommon for a funder to bargain for a fee equating to 300% of the capital reserved for the litigation on top of recouping their original investment in the case.

Fortunately, these prices are coming down. This is a result of natural competitive forces at work in a market which is seeing a new entrant at a rate of about 1 every 3 months. However, it is also down to the fact that funding is being applied to specialist areas where funders can afford to reduce their prices against a portfolio of work rather than a one-off case.

Counsel engaged by firms who have not appreciated the opportunity to solidify their panel relationships by presenting risk transfer and funding options would do well raise it with them. Some in-house legal teams have recognised the opportunity to outsource funding and hedge risk through insurance before their panel solicitors have. The chambers who are known to funders (and their risk managers) as barristers willing to share some degree of risk via a partial CFA (and one day DBAs) will have the best chance of receiving introductions from those commercial clients who approach funders directly. The common response of “my client is not interested in hedging risk or funding as they have deep pockets” may now be out-dated as, in the wake of the economic downturn, clients are increasingly coming forward to find solutions on their own, proving that this notion is certainly now fundamentally flawed.

Matthew Amey is a director of litigation risk transfer broker The Judge

Nonetheless, recoverability of CFA success fees has meant that the CFA retainer, as a funding option, has allowed counsel greater control over who can access their expertise. Recoverability of CFA success fees has meant that, where counsel is willing to share risk with an impecunious client, and provided the success fee can be justified, there is a workable mechanism to do so without diluting the client’s damages award.

The same has been true of after the event (‘ATE’) insurance with recoverable premiums. Outside of personal injury, most ATE policies will, in the absence of a CFA, cover barristers’ fees as standard. ATE insurers used to be less willing to offer such cover but over the years, they have become more sanguine about this as it has become increasingly apparent that getting a barrister to agree to act under a CFA does not automatically mean there is a good case. Recoverable ATE premiums have allowed greater access to good quality counsel whose chambers are not willing for whatever reason to share risk via CFAs with their clients. Clients are far more willing to fund counsel’s fees as the case progresses if they know this outlay is covered by insurance in the event the case is lost.

All this however would be dismantled by the Legal Aid, Sentencing and Punishment of Offenders Bill which is implementing Sir Rupert Jackson’s recommendation to abolish recoverability of success fees and ATE premiums. Clause 41 requires that CFAs must provide that the success fee is subject to a maximum limit, the percentage not exceeding the percentage specified by an order made by the Lord Chancellor, and expressed as a percentage of the descriptions of damages awarded in the proceedings.

The real losers will be those clients who have less resource to bring their claims. Arguably, society at large also loses out as access to justice diminishes for individuals and small and medium sized enterprises (SMEs). A barrister’s ability to share risk and reap the reward for doing so will now be restricted to only high value litigation. Counsel will no longer be able to share risk in low value cases, no matter how meritorious or important it is, unless they are willing to do so in return for a disproportionately small reward. It seems improbable that this will happen too often. As a result, fewer litigants with lower value cases will be able to fund the fees of a good quality barrister, and the playing field will be tipped in favour of the party with the better resources.

The introduction of Damages Based Agreements (‘DBAs’) does nothing to help the lower value cases but it could be good news for counsel engaged on very high value disputes. A DBA can provide a far greater return for sharing risk than a CFA uplift which is capped at 100% of fees. For the most highly regarded barristers, DBAs represent a chance to make a great deal of money on “big ticket” commercial litigation, provided they can pick the winners. However, it is probably a mirage for counsel occupying the tiers below the top. With the removal of recoverability also comes the introduction of real price competition within the profession in relation to the “reward” element of a CFA or DBA. Many solicitors and counsel will find themselves having to reduce their success fee element in order to secure instructions. Indeed, some solicitors in personal injury claims are predicting a world of CFAs without any success fees.

The silver lining attached to the Government’s proposals for counsel is that the reforms will bolster the nascent litigation funding market. Whilst DBAs represent competition for Third Party Funders, barristers will be more interested in the ability of the client to secure external litigation financing in order to pay their hourly rates as the case progresses.

Third Party Funding has had a limited impact on the profession to date as a result of the small number of companies in the market offering funding and because the fees charged have been expensive (typically expressed as a percentage of the damages or a multiple of the amount of funding committed). It is not uncommon for a funder to bargain for a fee equating to 300% of the capital reserved for the litigation on top of recouping their original investment in the case.

Fortunately, these prices are coming down. This is a result of natural competitive forces at work in a market which is seeing a new entrant at a rate of about 1 every 3 months. However, it is also down to the fact that funding is being applied to specialist areas where funders can afford to reduce their prices against a portfolio of work rather than a one-off case.

Counsel engaged by firms who have not appreciated the opportunity to solidify their panel relationships by presenting risk transfer and funding options would do well raise it with them. Some in-house legal teams have recognised the opportunity to outsource funding and hedge risk through insurance before their panel solicitors have. The chambers who are known to funders (and their risk managers) as barristers willing to share some degree of risk via a partial CFA (and one day DBAs) will have the best chance of receiving introductions from those commercial clients who approach funders directly. The common response of “my client is not interested in hedging risk or funding as they have deep pockets” may now be out-dated as, in the wake of the economic downturn, clients are increasingly coming forward to find solutions on their own, proving that this notion is certainly now fundamentally flawed.

Matthew Amey is a director of litigation risk transfer broker The Judge

Matthew Amey looks at the removal of recoverability of success fees and ATE insurance premiums, and the impact this will have on commercial litigation counsel

Matthew Amey looks at the removal of recoverability of success fees and ATE insurance premiums, and the impact this will have on commercial litigation counsel

Losing recoverability means losing control. Over the past decade, not all barristers have embraced the idea of sharing risk with their clients through conditional fee arrangements (‘CFAs’). Indeed, some felt that it adversely affected their independence when providing advice to the client, particularly with regard to settlement offers.

The Bar Council is ready to support a turn to the efficiencies that will make a difference

By Louise Crush of Westgate Wealth Management

Marie Law, Director of Toxicology at AlphaBiolabs, examines the latest ONS data on drug misuse and its implications for toxicology testing in family law cases

An interview with Rob Wagg, CEO of New Park Court Chambers

What meaningful steps can you take in 2026 to advance your legal career? asks Thomas Cowan of St Pauls Chambers

Marie Law, Director of Toxicology at AlphaBiolabs, explains why drugs may appear in test results, despite the donor denying use of them

Ever wondered what a pupillage is like at the CPS? This Q and A provides an insight into the training, experience and next steps

The appointments of 96 new King’s Counsel (also known as silk) are announced today

Ready for the new way to do tax returns? David Southern KC continues his series explaining the impact on barristers. In part 2, a worked example shows the specific practicalities of adapting to the new system

Resolution of the criminal justice crisis does not lie in reheating old ideas that have been roundly rejected before, say Ed Vickers KC, Faras Baloch and Katie Bacon

With pupillage application season under way, Laura Wright reflects on her route to ‘tech barrister’ and offers advice for those aiming at a career at the Bar