*/

In the January 2022 issue of Counsel, we looked at three worked scenarios which demonstrated the benefits of incorporating. In all those scenarios, there were retained profits left in the company to be extracted at a future date. This article illustrates three scenarios where the retained profits have been invested.

While holding funds in cash may seem prudent due to perceived lower risk, in actuality the effect of inflation will diminish the purchasing power of cash savings over the longer term. Investing allows the opportunity to target higher returns over this period thus retaining value in real terms versus inflation. For the purposes of this article, all returns are deemed net of charges.

A company can invest in largely the same assets as an individual can, including:

Typically, a managed portfolio will be used to remove the stress/time required for a business owner to take on the responsibility of investment selection.

Using three scenarios where post-tax retained profits are to be invested by the company, this article will demonstrate the effect of compounded returns.

1. Scenario A: The post-tax retained profits invested by the company are £50,000.

2. Scenario B: The post-tax retained profits invested by the company are £100,000.

3. Scenario C: The post-tax retained profits invested by the company are £200,000.

A five-year and ten-year period of growth has been assumed as well as an average growth rate of 4%.

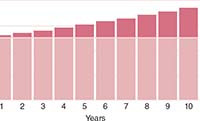

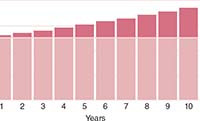

This is based on an initial investment of £50,000. Assuming that £50,000 is added annually the projections are as follows:

Based on the above, the effects of compounding are clear over the longer term. The ability to invest funds within a company without an immediate tax liability can prove useful should there be no short-term requirement to extract profits from the business.

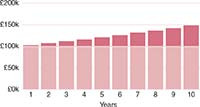

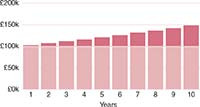

A five-year and ten-year period of growth has been assumed as well as an average growth rate of 4%:

This is based on an initial investment of £100,000. Assuming that £100,000 is also added annually, the projections are as follows:

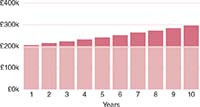

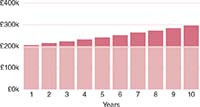

A five-year and ten-year period of growth has been assumed as well as an average growth rate of 4%:

This is based on an initial investment of £200,000. Assuming that £200,000 is also added annually the projections are as follows:

The above examples indicate the benefit that compounded returns can have over time; particularly when further funds are added each year, and growth can rapidly accelerate. With one view on retirement, building wealth within a company to draw out as dividends in future could be a viable option for many barristers. Combined with a comprehensive plan incorporating pension provision, this can provide a tax-efficient means of building and then extracting wealth from a company. Investing in any asset carries a degree of risk, even cash deposits. By constructing a well-diversified portfolio which is invested appropriately in line with an agreed level of risk, higher returns can be targeted than would be otherwise achieved through retaining funds in cash-based holdings. A professional investment manager can take the stress of constructing and managing a portfolio on an ongoing basis away.

It is important that qualified advice is taken regarding the most efficient way to extract profits from your business. Tax planning can be a costly area should mistakes be made. However, a robust plan can ensure that your business does not overpay.

Upon reaching retirement, the ability to draw funds from the business via dividends also provides a tax-efficient route to extracting profits. When combined with State provision, pension funds and other assets, the opportunity to draw an income efficiently from the company can prove effective. Advice should be taken in this area and typically a combination of financial planning and accountancy advice will deliver the most comprehensive solution.

The lifetime pension allowance is currently £1,073,100 and is a cumulative amount over all the pension schemes you have. If you exceed your lifetime pension allowance, you will have to pay tax on the excess amount. If you are in danger of exceeding your lifetime allowance, then incorporating and using the above process could be a way of saving further income for retirement. Check with your pension provider(s) if unsure of how much of your lifetime pension allowance you have used.

The value of an investment and the income from it can go down as well as up and investors may not get back the amount invested. This may be partly the result of exchange rate fluctuations in investments which have an exposure to foreign currencies. You should be aware that past performance is no guarantee of future performance. Please note that the above examples have used the tax rates for the tax year to 5 April 2022. It is known that certain tax rates are going to increase including national insurance rates (which will impact sole traders), corporation tax rates and dividend rates (which will impact the limited company tax rates and related profit extraction). This article contains some of the important considerations, but every individual’s personal circumstances are different and there might be further considerations not mentioned here. Therefore, it is important to seek professional advice from an accountant if you are looking to incorporate or from a financial planner regarding investments. This article is provided without any acceptance by RWB CA Limited/ RWB Wealth Management Limited, or any of their employees, of any responsibility whatsoever and any use you wish to make of the information is therefore entirely at your own risk.

In the January 2022 issue of Counsel, we looked at three worked scenarios which demonstrated the benefits of incorporating. In all those scenarios, there were retained profits left in the company to be extracted at a future date. This article illustrates three scenarios where the retained profits have been invested.

While holding funds in cash may seem prudent due to perceived lower risk, in actuality the effect of inflation will diminish the purchasing power of cash savings over the longer term. Investing allows the opportunity to target higher returns over this period thus retaining value in real terms versus inflation. For the purposes of this article, all returns are deemed net of charges.

A company can invest in largely the same assets as an individual can, including:

Typically, a managed portfolio will be used to remove the stress/time required for a business owner to take on the responsibility of investment selection.

Using three scenarios where post-tax retained profits are to be invested by the company, this article will demonstrate the effect of compounded returns.

1. Scenario A: The post-tax retained profits invested by the company are £50,000.

2. Scenario B: The post-tax retained profits invested by the company are £100,000.

3. Scenario C: The post-tax retained profits invested by the company are £200,000.

A five-year and ten-year period of growth has been assumed as well as an average growth rate of 4%.

This is based on an initial investment of £50,000. Assuming that £50,000 is added annually the projections are as follows:

Based on the above, the effects of compounding are clear over the longer term. The ability to invest funds within a company without an immediate tax liability can prove useful should there be no short-term requirement to extract profits from the business.

A five-year and ten-year period of growth has been assumed as well as an average growth rate of 4%:

This is based on an initial investment of £100,000. Assuming that £100,000 is also added annually, the projections are as follows:

A five-year and ten-year period of growth has been assumed as well as an average growth rate of 4%:

This is based on an initial investment of £200,000. Assuming that £200,000 is also added annually the projections are as follows:

The above examples indicate the benefit that compounded returns can have over time; particularly when further funds are added each year, and growth can rapidly accelerate. With one view on retirement, building wealth within a company to draw out as dividends in future could be a viable option for many barristers. Combined with a comprehensive plan incorporating pension provision, this can provide a tax-efficient means of building and then extracting wealth from a company. Investing in any asset carries a degree of risk, even cash deposits. By constructing a well-diversified portfolio which is invested appropriately in line with an agreed level of risk, higher returns can be targeted than would be otherwise achieved through retaining funds in cash-based holdings. A professional investment manager can take the stress of constructing and managing a portfolio on an ongoing basis away.

It is important that qualified advice is taken regarding the most efficient way to extract profits from your business. Tax planning can be a costly area should mistakes be made. However, a robust plan can ensure that your business does not overpay.

Upon reaching retirement, the ability to draw funds from the business via dividends also provides a tax-efficient route to extracting profits. When combined with State provision, pension funds and other assets, the opportunity to draw an income efficiently from the company can prove effective. Advice should be taken in this area and typically a combination of financial planning and accountancy advice will deliver the most comprehensive solution.

The lifetime pension allowance is currently £1,073,100 and is a cumulative amount over all the pension schemes you have. If you exceed your lifetime pension allowance, you will have to pay tax on the excess amount. If you are in danger of exceeding your lifetime allowance, then incorporating and using the above process could be a way of saving further income for retirement. Check with your pension provider(s) if unsure of how much of your lifetime pension allowance you have used.

The value of an investment and the income from it can go down as well as up and investors may not get back the amount invested. This may be partly the result of exchange rate fluctuations in investments which have an exposure to foreign currencies. You should be aware that past performance is no guarantee of future performance. Please note that the above examples have used the tax rates for the tax year to 5 April 2022. It is known that certain tax rates are going to increase including national insurance rates (which will impact sole traders), corporation tax rates and dividend rates (which will impact the limited company tax rates and related profit extraction). This article contains some of the important considerations, but every individual’s personal circumstances are different and there might be further considerations not mentioned here. Therefore, it is important to seek professional advice from an accountant if you are looking to incorporate or from a financial planner regarding investments. This article is provided without any acceptance by RWB CA Limited/ RWB Wealth Management Limited, or any of their employees, of any responsibility whatsoever and any use you wish to make of the information is therefore entirely at your own risk.

The Bar Council is ready to support a turn to the efficiencies that will make a difference

A £500 donation from AlphaBiolabs has been made to the leading UK charity tackling international parental child abduction and the movement of children across international borders

By Louise Crush of Westgate Wealth Management

Marie Law, Director of Toxicology at AlphaBiolabs, examines the latest ONS data on drug misuse and its implications for toxicology testing in family law cases

An interview with Rob Wagg, CEO of New Park Court Chambers

What meaningful steps can you take in 2026 to advance your legal career? asks Thomas Cowan of St Pauls Chambers

With at least 31 reports of AI hallucinations in UK legal cases – over 800 worldwide – and judges using AI to assist in judicial decision-making, the risks and benefits are impossible to ignore. Matthew Lee examines how different jurisdictions are responding

Ever wondered what a pupillage is like at the CPS? This Q and A provides an insight into the training, experience and next steps

The appointments of 96 new King’s Counsel (also known as silk) are announced today

Resolution of the criminal justice crisis does not lie in reheating old ideas that have been roundly rejected before, say Ed Vickers KC, Faras Baloch and Katie Bacon

With pupillage application season under way, Laura Wright reflects on her route to ‘tech barrister’ and offers advice for those aiming at a career at the Bar