*/

From April 2026 the way in which self-employed barristers must account for income tax on their earnings will change fundamentally. HMRC describes this as a new service for their customers. It is called Making Tax Digital for Income Tax Self-Assessment (MTD for Income Tax or MTD for ITSA). Those who are introducing these changes may be unconscious of the tremendous revolution they are preparing.

There are three aspects to the new system:

The legislation is drafted on an ‘unless’ basis, not an ‘if’ basis. In other words, it applies to all members of a group unless an exemption applies.

The persons affected are ‘relevant persons’. These are (Taxes Management Act 1970 (‘TMA’), Sch A1, para 1):

The detailed rules are to be found in the Income Tax (Digital Requirements) Regulations (SI 2021/1076) (‘DR Regs’).

A relevant person is accordingly any individual in receipt of income from self-employment or income from land above the stipulated threshold. This will in due course include a partnership if one member is within the charge to income tax, but a date has not been set for partnerships.

Income is ‘qualifying income’ within the new rules if it above a certain threshold. ‘Qualifying income’ is measured by reference to the income for the previous tax year [reg 21(5)]. The threshold will be reduced progressively over the next three years.

The ‘qualifying amount’ is (reg 21):

The centrepiece of the new system is the obligation to make quarterly returns of income and expenses by means of a digital interface.

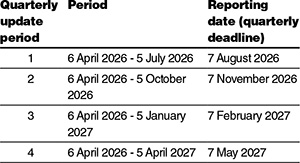

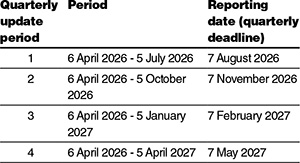

In 2026/27 and subsequent years, quarterly reporting dates are 30 days after the end of the income tax quarter. The dates of quarterly updates in 2026/27 are (SI/2021/1076, r 7):

In 2027/28 and subsequent years the same pattern continues.

By contrast, quarterly VAT returns must be made one month and seven days after the end of the VAT quarter (VAT Regulations, SI 1995/2518, reg 25A).

A ‘calendar quarters election’ may be made to move the starting date back to 1 April (reg 7(6)-(13)). This will chiefly be of value to those who want to request to move their VAT reporting group to the 31 March reporting period, so as to align their VAT quarters to income tax calendar quarters (VAT Regulations, reg 25).

The quarterly returns are on an incremental basis. No new payment obligations are attached to the quarterly information returns at this stage. It is necessary to keep separate digital records for each MTD source.

These rules do not prescribe what information has to be provided. Reg 7(1) simply says:

‘ (1) A relevant person must provide update information for a business, as specified in an update notice, in respect of each quarterly update period for each year.’

The ‘update information’ is defined in reg 2 as:

‘financial information and other information in respect of the business of a relevant person for a quarterly update period’.

Guidance from the Institute of Chartered Accountants in England and Wales suggests that the update information should be a summary of all transactions that have taken place in the relevant period.

While the Regulations deal with mechanical and procedural matters (‘how’), the substantive tax rules remain in the legislation on income tax (‘what’).

The crucial question is, what has to be reported?

There are two possible bases:

The cash basis was abolished in 1998, subject to an exception for new businesses and barristers in the first seven years of practice, who could retain the cash basis. Barristers were required to bring in work in progress as well as year-end debtors (Income Tax (Trading and Other Income) Act 2005 (‘ITTOIA’), s 25(1)).

In 2013 the cash basis was reinstated in a limited form for small unincorporated businesses and barristers in the first seven years of practice (ITTOIA, ss 31A-31F).

From 2024/25 profits and losses had to be apportioned to the tax year if the accounting period did not coincide with the tax year (ITTOIA, s 7A).

This change was linked to a fundamental change. The existing rule that the accounts basis was the rule and the cash basis the exception was reversed:

What this means is that every barrister, whether their annual income is £10,000 or £1m, can revert to taxation on a cash basis. From 2024/25 a business is not restricted from using the cash basis by reason of having too large a turnover.

This is a complete reversal of everything that had happened since 1998.

It follows that what has to be reported in quarterly updates is dependent upon whether the taxpayer is accounting for profits on a cash or an accounts basis.

If the taxpayer calculates their profits on a cash basis, the figures they have to put in their quarterly updates will be cash figures.

If the taxpayer calculates their profits on an accounts basis, the figures they have to put in quarterly updates will be earnings based. However, an earnings basis for profit can only be drawn up after the year end. This does not reconcile with quarterly reporting. What will be reported in practice is likely to be a watered-down version of accruals, which is going to end up more like the cash basis.

In a sense this does not matter as there are no associated payment obligations and no penalties for inaccuracy. However, once items have been digitally recorded and included in a quarterly update, the figures cannot be altered.

The digital start date for existing businesses is 6 April 2026 (reg 4).

The new system is modelled on MTD for VAT (MTDfV), which was introduced from 2019/20.

The majority of VAT registered businesses account for VAT on a cash basis, if their annual turnover is under £1,350,000 (VAT Regulations, SI 1995/2518, regs 56-65).

The giving of the quietus to the accounts basis for income tax appears to have been designed to align income tax with VAT, once quarterly reporting for income tax was introduced.

VAT records have to be kept digitally, using ‘functional compatible software’, i.e. software which can connect to HMRC systems via an application programming interface (API) which must be capable of:

However, there are three fundamental distinctions between MTDfV and MTD for ITSA:

For all forms of non-compliance including failure to keep digital records or missed deadlines automatic penalties are generated by computer.

There are no penalties for inaccuracies in quarterly updates, because these can be corrected in subsequent updates.

The new system makes the use of agents compulsory because, even if the barrister records their own income and expenditure digitally, they must use an Agent Service Account (ASA) which is digitally linked both to their records and to HMRC so that each quarterly update will be transmitted direct to HMRC, which then has access to the underlying digital records. This is ‘linking’ software, i.e. software which links the taxpayer’s records automatically to the HMRC records.

At the same time HMRC is withdrawing its own software, therefore requiring taxpayers to use commercial software from any number of sources.

Many UK accounting and bookkeeping practices use multiple tools and different software programmes for different aspects of client business, e.g:

New integrated programmes are being offered, which combine all these functions.

In general, there are a multitude of new software systems, most being designed for agent use with multiple clients, but some designed for individual use for the heroic minority who wish to make their own quarterly updates.

When I was in the Inland Revenue, the great anathema of the tax system was cash accounting. This was for four reasons: (i) it deferred recognition of income; (ii) it accelerated deduction of expenses; (iii) it lacked the discipline of double entry; (iv) cash could pass off the books.

For the sake of simplicity alone, a large number of barristers may opt out of the earnings basis for 2024/25 and revert to the cash basis.

HMRC has put enormous effort and resources into the realisation of MTD for ITSA. I have found their seminars well organised, interesting and illuminating.

MTD for ITSA will not raise a single penny of additional tax, and is of no use to man or beast. To the extent that it leads to a widespread revival of the cash basis, it will lead to loss of revenue, besides doing needless violence to 100 years of tax history.

The new system combines an extreme of rigidity as to the ‘how’, with an extreme of flexibility as to the ‘what’. This seems to me incoherent. The digital tail is wagging the tax dog. It marks the triumph of digitalisation over the principles of income tax.

From April 2026 the way in which self-employed barristers must account for income tax on their earnings will change fundamentally. HMRC describes this as a new service for their customers. It is called Making Tax Digital for Income Tax Self-Assessment (MTD for Income Tax or MTD for ITSA). Those who are introducing these changes may be unconscious of the tremendous revolution they are preparing.

There are three aspects to the new system:

The legislation is drafted on an ‘unless’ basis, not an ‘if’ basis. In other words, it applies to all members of a group unless an exemption applies.

The persons affected are ‘relevant persons’. These are (Taxes Management Act 1970 (‘TMA’), Sch A1, para 1):

The detailed rules are to be found in the Income Tax (Digital Requirements) Regulations (SI 2021/1076) (‘DR Regs’).

A relevant person is accordingly any individual in receipt of income from self-employment or income from land above the stipulated threshold. This will in due course include a partnership if one member is within the charge to income tax, but a date has not been set for partnerships.

Income is ‘qualifying income’ within the new rules if it above a certain threshold. ‘Qualifying income’ is measured by reference to the income for the previous tax year [reg 21(5)]. The threshold will be reduced progressively over the next three years.

The ‘qualifying amount’ is (reg 21):

The centrepiece of the new system is the obligation to make quarterly returns of income and expenses by means of a digital interface.

In 2026/27 and subsequent years, quarterly reporting dates are 30 days after the end of the income tax quarter. The dates of quarterly updates in 2026/27 are (SI/2021/1076, r 7):

In 2027/28 and subsequent years the same pattern continues.

By contrast, quarterly VAT returns must be made one month and seven days after the end of the VAT quarter (VAT Regulations, SI 1995/2518, reg 25A).

A ‘calendar quarters election’ may be made to move the starting date back to 1 April (reg 7(6)-(13)). This will chiefly be of value to those who want to request to move their VAT reporting group to the 31 March reporting period, so as to align their VAT quarters to income tax calendar quarters (VAT Regulations, reg 25).

The quarterly returns are on an incremental basis. No new payment obligations are attached to the quarterly information returns at this stage. It is necessary to keep separate digital records for each MTD source.

These rules do not prescribe what information has to be provided. Reg 7(1) simply says:

‘ (1) A relevant person must provide update information for a business, as specified in an update notice, in respect of each quarterly update period for each year.’

The ‘update information’ is defined in reg 2 as:

‘financial information and other information in respect of the business of a relevant person for a quarterly update period’.

Guidance from the Institute of Chartered Accountants in England and Wales suggests that the update information should be a summary of all transactions that have taken place in the relevant period.

While the Regulations deal with mechanical and procedural matters (‘how’), the substantive tax rules remain in the legislation on income tax (‘what’).

The crucial question is, what has to be reported?

There are two possible bases:

The cash basis was abolished in 1998, subject to an exception for new businesses and barristers in the first seven years of practice, who could retain the cash basis. Barristers were required to bring in work in progress as well as year-end debtors (Income Tax (Trading and Other Income) Act 2005 (‘ITTOIA’), s 25(1)).

In 2013 the cash basis was reinstated in a limited form for small unincorporated businesses and barristers in the first seven years of practice (ITTOIA, ss 31A-31F).

From 2024/25 profits and losses had to be apportioned to the tax year if the accounting period did not coincide with the tax year (ITTOIA, s 7A).

This change was linked to a fundamental change. The existing rule that the accounts basis was the rule and the cash basis the exception was reversed:

What this means is that every barrister, whether their annual income is £10,000 or £1m, can revert to taxation on a cash basis. From 2024/25 a business is not restricted from using the cash basis by reason of having too large a turnover.

This is a complete reversal of everything that had happened since 1998.

It follows that what has to be reported in quarterly updates is dependent upon whether the taxpayer is accounting for profits on a cash or an accounts basis.

If the taxpayer calculates their profits on a cash basis, the figures they have to put in their quarterly updates will be cash figures.

If the taxpayer calculates their profits on an accounts basis, the figures they have to put in quarterly updates will be earnings based. However, an earnings basis for profit can only be drawn up after the year end. This does not reconcile with quarterly reporting. What will be reported in practice is likely to be a watered-down version of accruals, which is going to end up more like the cash basis.

In a sense this does not matter as there are no associated payment obligations and no penalties for inaccuracy. However, once items have been digitally recorded and included in a quarterly update, the figures cannot be altered.

The digital start date for existing businesses is 6 April 2026 (reg 4).

The new system is modelled on MTD for VAT (MTDfV), which was introduced from 2019/20.

The majority of VAT registered businesses account for VAT on a cash basis, if their annual turnover is under £1,350,000 (VAT Regulations, SI 1995/2518, regs 56-65).

The giving of the quietus to the accounts basis for income tax appears to have been designed to align income tax with VAT, once quarterly reporting for income tax was introduced.

VAT records have to be kept digitally, using ‘functional compatible software’, i.e. software which can connect to HMRC systems via an application programming interface (API) which must be capable of:

However, there are three fundamental distinctions between MTDfV and MTD for ITSA:

For all forms of non-compliance including failure to keep digital records or missed deadlines automatic penalties are generated by computer.

There are no penalties for inaccuracies in quarterly updates, because these can be corrected in subsequent updates.

The new system makes the use of agents compulsory because, even if the barrister records their own income and expenditure digitally, they must use an Agent Service Account (ASA) which is digitally linked both to their records and to HMRC so that each quarterly update will be transmitted direct to HMRC, which then has access to the underlying digital records. This is ‘linking’ software, i.e. software which links the taxpayer’s records automatically to the HMRC records.

At the same time HMRC is withdrawing its own software, therefore requiring taxpayers to use commercial software from any number of sources.

Many UK accounting and bookkeeping practices use multiple tools and different software programmes for different aspects of client business, e.g:

New integrated programmes are being offered, which combine all these functions.

In general, there are a multitude of new software systems, most being designed for agent use with multiple clients, but some designed for individual use for the heroic minority who wish to make their own quarterly updates.

When I was in the Inland Revenue, the great anathema of the tax system was cash accounting. This was for four reasons: (i) it deferred recognition of income; (ii) it accelerated deduction of expenses; (iii) it lacked the discipline of double entry; (iv) cash could pass off the books.

For the sake of simplicity alone, a large number of barristers may opt out of the earnings basis for 2024/25 and revert to the cash basis.

HMRC has put enormous effort and resources into the realisation of MTD for ITSA. I have found their seminars well organised, interesting and illuminating.

MTD for ITSA will not raise a single penny of additional tax, and is of no use to man or beast. To the extent that it leads to a widespread revival of the cash basis, it will lead to loss of revenue, besides doing needless violence to 100 years of tax history.

The new system combines an extreme of rigidity as to the ‘how’, with an extreme of flexibility as to the ‘what’. This seems to me incoherent. The digital tail is wagging the tax dog. It marks the triumph of digitalisation over the principles of income tax.

Kirsty Brimelow KC, Chair of the Bar, sets our course for 2026

What meaningful steps can you take in 2026 to advance your legal career? asks Thomas Cowan of St Pauls Chambers

Marie Law, Director of Toxicology at AlphaBiolabs, explains why drugs may appear in test results, despite the donor denying use of them

Asks Louise Crush of Westgate Wealth Management

AlphaBiolabs has donated £500 to The Christie Charity through its Giving Back initiative, helping to support cancer care, treatment and research across Greater Manchester, Cheshire and further afield

Q and A with criminal barrister Nick Murphy, who moved to New Park Court Chambers on the North Eastern Circuit in search of a better work-life balance

The appointments of 96 new King’s Counsel (also known as silk) are announced today

With pupillage application season under way, Laura Wright reflects on her route to ‘tech barrister’ and offers advice for those aiming at a career at the Bar

Jury-less trial proposals threaten fairness, legitimacy and democracy without ending the backlog, writes Professor Cheryl Thomas KC (Hon), the UK’s leading expert on juries, judges and courts

Are you ready for the new way to do tax returns? David Southern KC explains the biggest change since HMRC launched self-assessment more than 30 years ago... and its impact on the Bar

Marking one year since a Bar disciplinary tribunal dismissed all charges against her, Dr Charlotte Proudman discusses the experience, her formative years and next steps. Interview by Anthony Inglese CB