*/

A major change is coming which will impact the timing and way profits are taxed. What is basis period reform and how does it affect barristers? Nick Bonnello explains all...

Basis period reform impacts upon all barristers who trade as sole traders and who do not have an accounting year end on, or in between, 31 March and 5 April. It applies to year ends ending after 5 April 2023. If you have a 30 April year end then this will affect you from 1 May 2022.

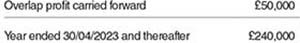

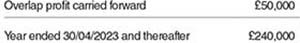

When you begin trading, you can choose when your accounting period ends each year. This is almost always a month end, and most barristers choose either a 30 April or 31 March year end.

Your personal tax return is then prepared using the accounts with a year end falling in the fiscal year to 5 April. So, the personal tax year to 5 April 2022 would include your 30 April 2021 accounts if you are using an April year end, or your 31 March 2022 accounts if you are using a March year end.

Starting from the 2024/25 tax year the basis period in which profits/losses are declared on your tax returns will be prepared on the ‘tax year basis’ (profits assessed based pro-rata from 6 April to 5 April), having previously been prepared on the ‘current year basis’ (based on your accounting year end).

To ensure the 2024/25 year can be prepared on a tax year basis, the 2023/24 tax year will be used as a ‘transitional year’. Any businesses not using an accounting year end between 31 March and 5 April will need to include an elongated period of accounts up to 5 April 2024, less any overlap profit retained from earlier years (note that overlap profit must be offset against the profit and can’t be deferred for a later time, such as retirement). If you do not know what your overlap profits are, your accountant should hold this information, or be able to retrieve this from HMRC.

You don’t have to change your accounting year end and can continue as before – but where your accounting year end is not on, or in between, 31 March and 5 April, you would need to include an apportionment when it comes to preparing your tax return. You might want to simplify the tax calculation and align your accounting year end with the tax year end by changing to a 31 March or 5 April year end. However, if you are changing your year end please be aware that you should only do this in the tax year ended 2023/24 (and not before) to ensure you can spread the additional tax liability over five years (see below).

There are further complications depending upon when your accounts year end falls within the tax year to 5 April. A December accounts year end straddles two tax years to 5 April, so to file a tax return by the 31 January deadline effectively means that you have just one month to prepare your accounts so that they can be apportioned between pre- and post- 5 April. With a January or February accounts year end, estimates would have to be used. In practice, most barristers have year ends either at 31 March or early in the tax year – 30 April or 31 May – so they will have time to prepare accurate figures. However, any additional work for your accountant may result in additional fees.

This impacts the tax payable through bringing forward the time in which tax on profits is due for payment. Therefore, this will affect your cash flow as more tax will be payable over the next five years. The most significant impact on barristers will be those with a 30 April year end as they will be subject to tax on both the usual full year’s profits and, in addition, one-fifth of 340 days of the following accounting year end, less overlap profit. The remaining four-fifths are then payable over the next four years.

Please note that in addition to the larger tax liability for 2023/24, the payments on account for 2024/25 based on the profit levels for 2023/24 would also be larger than in previous years.

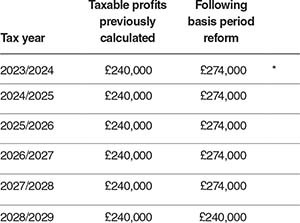

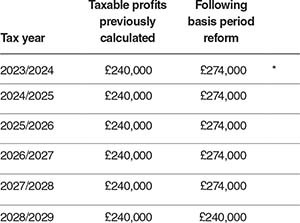

This example demonstrates how the taxable profits will be affected over the next five years when a business has a 30 April year end.

For clarity on how the spreading will affect the taxable profits, the monthly profits are assumed to be consistent throughout the year. In this circumstance, there would be no changes if the business changes to a 31 March year end in 2023/24 or uses the apportionment of eleven-twelfths of the April year end. A difference would occur where profits in April vary from the other months.

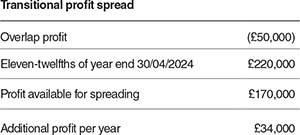

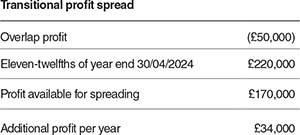

The transitional profit to be spread would be calculated as:

The transitional profit of £170,000 is then split equally over the next five tax years and included in the taxable profits previously calculated.

After five years of spreading, your taxable profit would return to its ‘normal’ level and you would be paying tax on your profits earned in the tax year it falls in.

* Please note that in addition to the additional £34,000 of profits that will be taxed, there will also be an increased payment on account for half the uplifted amount payable (£17,000) in both January 2025 and July 2025.

A limited company is not subject to the basis period reform (please see my articles on incorporation for Counsel: ‘Time to look at incorporating?’ December 2021 and ‘Incorporation for retirement planning’ January 2022). You could continue trading using your current accounting year, and benefit from other factors of trading through a limited company.

If your income does fluctuate each month, it might be worth speaking to your accountant as this will be relevant in determining whether you change your year end or use the apportionment method. At RWB Chartered Accountants we are currently offering a fixed consultancy review using your personal projections to determine the best outcome for you personally, for £600 + VAT.

This article contains some important considerations, but every individual’s personal circumstances are different and there might be further considerations not mentioned in this article. Therefore, it is important to seek professional advice from an accountant if you are looking to change your accounting year end. This article is provided without any acceptance by RWB CA Ltd, or any of its staff, of any responsibility whatsoever, and any use you wish to make of the information is therefore entirely at your own risk.

Basis period reform impacts upon all barristers who trade as sole traders and who do not have an accounting year end on, or in between, 31 March and 5 April. It applies to year ends ending after 5 April 2023. If you have a 30 April year end then this will affect you from 1 May 2022.

When you begin trading, you can choose when your accounting period ends each year. This is almost always a month end, and most barristers choose either a 30 April or 31 March year end.

Your personal tax return is then prepared using the accounts with a year end falling in the fiscal year to 5 April. So, the personal tax year to 5 April 2022 would include your 30 April 2021 accounts if you are using an April year end, or your 31 March 2022 accounts if you are using a March year end.

Starting from the 2024/25 tax year the basis period in which profits/losses are declared on your tax returns will be prepared on the ‘tax year basis’ (profits assessed based pro-rata from 6 April to 5 April), having previously been prepared on the ‘current year basis’ (based on your accounting year end).

To ensure the 2024/25 year can be prepared on a tax year basis, the 2023/24 tax year will be used as a ‘transitional year’. Any businesses not using an accounting year end between 31 March and 5 April will need to include an elongated period of accounts up to 5 April 2024, less any overlap profit retained from earlier years (note that overlap profit must be offset against the profit and can’t be deferred for a later time, such as retirement). If you do not know what your overlap profits are, your accountant should hold this information, or be able to retrieve this from HMRC.

You don’t have to change your accounting year end and can continue as before – but where your accounting year end is not on, or in between, 31 March and 5 April, you would need to include an apportionment when it comes to preparing your tax return. You might want to simplify the tax calculation and align your accounting year end with the tax year end by changing to a 31 March or 5 April year end. However, if you are changing your year end please be aware that you should only do this in the tax year ended 2023/24 (and not before) to ensure you can spread the additional tax liability over five years (see below).

There are further complications depending upon when your accounts year end falls within the tax year to 5 April. A December accounts year end straddles two tax years to 5 April, so to file a tax return by the 31 January deadline effectively means that you have just one month to prepare your accounts so that they can be apportioned between pre- and post- 5 April. With a January or February accounts year end, estimates would have to be used. In practice, most barristers have year ends either at 31 March or early in the tax year – 30 April or 31 May – so they will have time to prepare accurate figures. However, any additional work for your accountant may result in additional fees.

This impacts the tax payable through bringing forward the time in which tax on profits is due for payment. Therefore, this will affect your cash flow as more tax will be payable over the next five years. The most significant impact on barristers will be those with a 30 April year end as they will be subject to tax on both the usual full year’s profits and, in addition, one-fifth of 340 days of the following accounting year end, less overlap profit. The remaining four-fifths are then payable over the next four years.

Please note that in addition to the larger tax liability for 2023/24, the payments on account for 2024/25 based on the profit levels for 2023/24 would also be larger than in previous years.

This example demonstrates how the taxable profits will be affected over the next five years when a business has a 30 April year end.

For clarity on how the spreading will affect the taxable profits, the monthly profits are assumed to be consistent throughout the year. In this circumstance, there would be no changes if the business changes to a 31 March year end in 2023/24 or uses the apportionment of eleven-twelfths of the April year end. A difference would occur where profits in April vary from the other months.

The transitional profit to be spread would be calculated as:

The transitional profit of £170,000 is then split equally over the next five tax years and included in the taxable profits previously calculated.

After five years of spreading, your taxable profit would return to its ‘normal’ level and you would be paying tax on your profits earned in the tax year it falls in.

* Please note that in addition to the additional £34,000 of profits that will be taxed, there will also be an increased payment on account for half the uplifted amount payable (£17,000) in both January 2025 and July 2025.

A limited company is not subject to the basis period reform (please see my articles on incorporation for Counsel: ‘Time to look at incorporating?’ December 2021 and ‘Incorporation for retirement planning’ January 2022). You could continue trading using your current accounting year, and benefit from other factors of trading through a limited company.

If your income does fluctuate each month, it might be worth speaking to your accountant as this will be relevant in determining whether you change your year end or use the apportionment method. At RWB Chartered Accountants we are currently offering a fixed consultancy review using your personal projections to determine the best outcome for you personally, for £600 + VAT.

This article contains some important considerations, but every individual’s personal circumstances are different and there might be further considerations not mentioned in this article. Therefore, it is important to seek professional advice from an accountant if you are looking to change your accounting year end. This article is provided without any acceptance by RWB CA Ltd, or any of its staff, of any responsibility whatsoever, and any use you wish to make of the information is therefore entirely at your own risk.

A major change is coming which will impact the timing and way profits are taxed. What is basis period reform and how does it affect barristers? Nick Bonnello explains all...

The Bar Council is ready to support a turn to the efficiencies that will make a difference

A £500 donation from AlphaBiolabs has been made to the leading UK charity tackling international parental child abduction and the movement of children across international borders

By Louise Crush of Westgate Wealth Management

Marie Law, Director of Toxicology at AlphaBiolabs, examines the latest ONS data on drug misuse and its implications for toxicology testing in family law cases

An interview with Rob Wagg, CEO of New Park Court Chambers

What meaningful steps can you take in 2026 to advance your legal career? asks Thomas Cowan of St Pauls Chambers

With at least 31 reports of AI hallucinations in UK legal cases – over 800 worldwide – and judges using AI to assist in judicial decision-making, the risks and benefits are impossible to ignore. Matthew Lee examines how different jurisdictions are responding

Ever wondered what a pupillage is like at the CPS? This Q and A provides an insight into the training, experience and next steps

The appointments of 96 new King’s Counsel (also known as silk) are announced today

Resolution of the criminal justice crisis does not lie in reheating old ideas that have been roundly rejected before, say Ed Vickers KC, Faras Baloch and Katie Bacon

With pupillage application season under way, Laura Wright reflects on her route to ‘tech barrister’ and offers advice for those aiming at a career at the Bar