*/

The Chair of the Bar sets out how the new government can restore the justice system

In the first of a new series, Louise Crush of Westgate Wealth considers the fundamental need for financial protection

Unlocking your aged debt to fund your tax in one easy step. By Philip N Bristow

Possibly, but many barristers are glad he did…

Mental health charity Mind BWW has received a £500 donation from drug, alcohol and DNA testing laboratory, AlphaBiolabs as part of its Giving Back campaign

The Institute of Neurotechnology & Law is thrilled to announce its inaugural essay competition

How to navigate open source evidence in an era of deepfakes. By Professor Yvonne McDermott Rees and Professor Alexa Koenig

Brie Stevens-Hoare KC and Lyndsey de Mestre KC take a look at the difficulties women encounter during the menopause, and offer some practical tips for individuals and chambers to make things easier

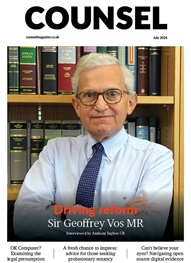

Sir Geoffrey Vos, Master of the Rolls and Head of Civil Justice since January 2021, is well known for his passion for access to justice and all things digital. Perhaps less widely known is the driven personality and wanderlust that lies behind this, as Anthony Inglese CB discovers

The Chair of the Bar sets out how the new government can restore the justice system

No-one should have to live in sub-standard accommodation, says Antony Hodari Solicitors. We are tackling the problem of bad housing with a two-pronged approach and act on behalf of tenants in both the civil and criminal courts